With offices in Bienne, Neuchâtel, Solothurn, Geneva and Lausanne and backed by around 50 employees, our companies, Frôté & Partner SA, Dynafisc Frôté SA and Schoeb Frôté SA offer comprehensive services to both individuals and companies under our « F&P » brand.

We support our clients in a wide range of areas – from legal counsel and notary public services to taxes, corporate management consulting, asset management as well as administrative services and accounting.

The pooling of the skills of our three companies, supplemented by the advanced know-how of our network of partners, makes it possible to offer global consulting services, meeting the current needs of companies and entrepreneurs. From limited-scope or task-based projects to comprehensive solutions involving all of our companies, such as Family Office set-ups, full management of estate planning or business transformation projects – whatever you need, F&P has the experience and expertise to assist.

Our services

Our companies have deep roots in Switzerland locally and nationally. We’ve developed an extensive partner network providing solutions for industrial Small to Medium-Sized Businesses (SMBs) and exporters along the Franco-Swiss border for decades. Our success has enabled us to expand our business beyond our borders to Europe, North America and Asia.

Our services are organized into four distinct hubs.

Frôté & Partner SA has been active in the main areas of law since 1936. The experience accumulated over decades in judicial activity, taxation and notarial services has gradually led to the development of advanced skills in the advice, in particular in the advice dedicated to companies, both at the regional and international levels.

Dynafisc Frôté SA aims to provide comprehensive consulting and administrative services to business owners and their managers. Thanks to all the skills that an experienced business administrator is able to use, it offers a full range of services in the areas of financial advice, tax expertise and administrative management. Founded in 2002 under the name "F&P Services SA", the company becomes "Dynafisc Frôté SA" in 2022, following the development of new skills and in particular the integration of Dynafisc SA and F&P Conseils SA.

We founded Schoeb Frôté SA in 2013 to offer Family Office and wealth management services for individuals as well as financial consulting for companies and pension funds. Our extensive experience in the field of wealth and financial management as well as our total independence allow us to offer tailor-made solutions, while offering our services at very attractive costs.

The set of skills made available by our companies is supplemented, according to the specific needs of our customers, by a network of partners developed over the years. These partnerships allow us to support our clients in highly specialized fields, such as insurance, Medtech or even Fintech.

We develop and use tools with the latest technology and specific programs to support our clients.

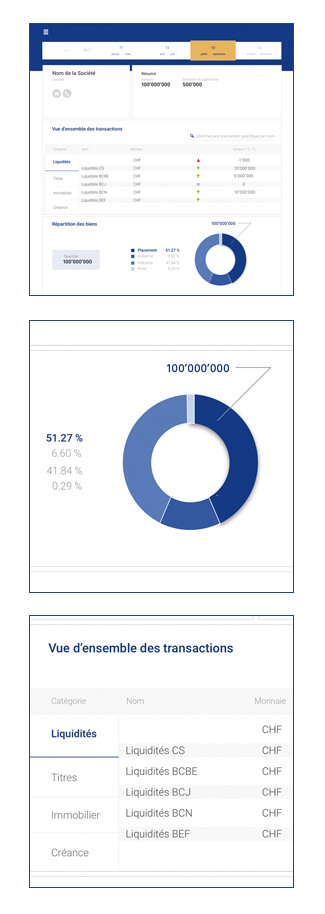

F&P System

« F&P System » is a digital asset tracking and analysis app developed specially for F&P Group by engineers at the Federal Institute of Technology Lausanne. We developed this user-friendly app for clients who want a simple way to monitor their assets and investments 24/7. We launched the app in 2017 after more than three years of development. It immediately became an indispensable tool not only for clients wanting to strategically manage their assets, but for consulting projects as well.

Casa Nexgen

The CASA NEXGEN program was set up in 2019 by Schoeb Frôté and our partner Capitalium to help families transfer their assets to future generations. We created this program in response to numerous studies showing that 90% of family fortunes vanished by the third generation. The program consists of four modules to help equip future generations with the skills and attitude they'll need to successfully navigate the responsibilities and challenges they'll face.

Our newsletters

(PDF files to download)

Contact

Biel-Bienne

Place Centrale 51

Case postale 480

CH-2501 Biel-Bienne

Tél. +41 32 322 25 21

Neuchâtel

Faubourg du Lac 11

Case postale 2333

CH-2001 Neuchâtel

Tél. +41 32 722 17 00

Solothurn

Westbahnhofstrasse 1

Postfach 333

CH-4502 Solothurn

Tél. +41 32 628 26 26

Geneva

Rue de la Pélisserie 16

CH-1204 Geneva

Tél. +41 22 544 63 00

Lausanne

Avenue Sainte-Luce 4

1003 Lausanne

Tél. +41 21 310 70 00